If you have recently purchased or refinanced your home, expect to get multiple offers from companies selling mortgage protection insurance. Many of these offers are scams.

If you have recently purchased or refinanced your home, expect to get multiple offers from companies selling mortgage protection insurance. Many of these offers are scams.

It may surprise you, but finding out who’s recently purchased a home is public information. Information on who purchased or refinanced a home loan, the lender, the loan amount, and the address the loan is associated with is readily available. Companies reach out to new homeowners at this time with offers like mortgage protection insurance.

Mortgage Protection Insurance is a legitimate type of insurance that can help your family stay in their home if you unexpectedly pass away. The money your family would receive can be used to pay off the mortgage. Unfortunately, scammers use this fear as a basis to get your money – or worse.

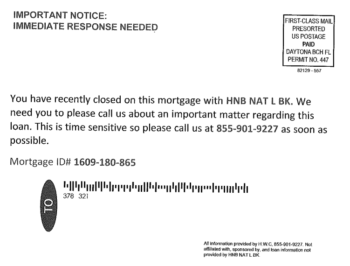

Scammers could use public data to contact potential victims, as in the example actual postcard below. Scammers may want your money, but many of them are also looking for your personal information to commit identity theft, so more than your money is at stake.

How to know if the solicitation is legitimate?

Spotting the difference between legitimate mortgage protection insurance providers and ‘scammers’ can be tough, but armed with some knowledge, you can protect yourself against fraud. Here are some ways to spot a mortgage protection insurance scam:

They ask for far too much information

Watch out for offers that ask for sensitive information like your social security number, bank account number, or credit card information. A reputable company will never ask for that information when they first reach out to you to see if you are interested in mortgage protection insurance.

They list a fake address

There should be a street address and contact number on the front of the invitation letter, and you should be able to look the address up on the internet and find the actual location on Google maps. If there is no address or phone number, throw that letter away.

They list a false license number (or no license number at all)

In every single state, insurance companies, brokers, and IMO’s (Independent Marketing Organizations) are regulated by the state Department of Insurance, and must list their license number on all of their advertisements and letters to clients. So check the letter to see if there is a license number.

No license number listed on a mortgage protection insurance letter? That’s a big red flag that the offer is a scam!

They threaten you with foreclosure

Some fraud artists even go as far as to threaten you with foreclosure on your home if you don’t sign up for mortgage protection insurance with them. They might send an official-looking letter saying that you must buy mortgage protection insurance by a certain date, otherwise, you’ll be in violation of the terms of your mortgage and your home could go into foreclosure. This is absolutely not true. Mortgage protection insurance is completely optional, another way to provide a financial safety net for your family, but not required. There is no relationship between mortgage protection insurance and the status of your home loan.

Interested in mortgage protection insurance, but not sure?

While it’s important to spot the signs of a mortgage protection insurance scam, it’s also important to know that most mortgage protection offers are legitimate. If you are interested in this type of insurance, follow our top tips below as you fill out an interest card or make a phone call to make sure the company is legitimate and trustworthy.

Top Tips

- Call them! Ask questions such as how long they have been in business, what their website is and more.

- Look them up online. A legitimate company should have a strong web presence. They should have a main website, be listed on the BBB and have various social media accounts (like Facebook).

- Read reviews about their company. Do a search for the company name and the word ‘reviews.’ You should find a variety of listings and ratings.

- All companies will have a mix of positive and negative reviews, but if they only have negative or no reviews, that’s a warning sign.

- What do their employees or partners say? Do a search for the company on a website like Glassdoor. This is a site where the employees or independent contractors leave reviews of the companies they work with. Again, you will see a mix of positive and negative reviews for all companies, but as you read through them, you will get a general sense of whether the company is legitimate or not.

The bottom line?

If you are interested in mortgage protection insurance, do your homework and go with a company you trust.